Indian Banking sector is going through a hard time due to various reasons including but not limited to increase in Gross Non-Performing Assets (GNPA), loan frauds/corruption in some cases, economic slowdown etc. Rise in NPAs is major concern for banks as it reduces profit of banks and restricts the loan giving ability of the banks by way of provisioning. Reasons for the rise in NPA can be attributed to aggressive lending practice by the banks and willful default by borrowers i.e., lack of willingness to repay. Another reason can also be lack of ability to repay the loans by the borrower; however this reason is less prevalent than willful default. Post 1991 various measures were taken to solve NPA problem which includes legal reforms, introduction of Asset Reconstruction Companies (ARCs), various kinds of restructuring schemes of NPAs including corporate debt restructuring, strategic debt restructuring, scheme for sustainable structuring of stressed Asset (S4A) etc.The legal reforms include setting up of Debt Recovery Tribunals to speed up of resolution of NPAs cases, enactment of SARFAESI (Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest)Act, 2002. However, these reforms could not realize the objective effectively and alsotook a substantial amount of time. Therefore, it required a more modern, sophisticated and robust resolution framework.

Indian Banking sector is going through a hard time due to various reasons including but not limited to increase in Gross Non-Performing Assets (GNPA), loan frauds/corruption in some cases, economic slowdown etc. Rise in NPAs is major concern for banks as it reduces profit of banks and restricts the loan giving ability of the banks by way of provisioning. Reasons for the rise in NPA can be attributed to aggressive lending practice by the banks and willful default by borrowers i.e., lack of willingness to repay. Another reason can also be lack of ability to repay the loans by the borrower; however this reason is less prevalent than willful default. Post 1991 various measures were taken to solve NPA problem which includes legal reforms, introduction of Asset Reconstruction Companies (ARCs), various kinds of restructuring schemes of NPAs including corporate debt restructuring, strategic debt restructuring, scheme for sustainable structuring of stressed Asset (S4A) etc.The legal reforms include setting up of Debt Recovery Tribunals to speed up of resolution of NPAs cases, enactment of SARFAESI (Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest)Act, 2002. However, these reforms could not realize the objective effectively and alsotook a substantial amount of time. Therefore, it required a more modern, sophisticated and robust resolution framework.

Scheme of the Insolvency Bankruptcy Code

Resolution of stressed assets (NPAs and restructured assets) requires coordinated approach of the government, the Central Bank (RBI), and the lending bank itself. In 2016, with this objective, the Insolvency Bankruptcy Code (hereinafter “the code”) was enacted which seeks to achieve resolution of distressed corporate debtors (CDs). It also facilitates liquidation in time bound manner under the supervision of National Company Law Tribunal (NCLT) if there is no resolution. The enactment of the codeis considered as a second-generation economic reform. In thefirst-generation economic reform, India allowed liberal entry of firms in the market whereas in the second-generation economic reform through the code, India allows smoother exit of inefficient firms from the market.

CORPORATE INSOLVENCY RESOLUTION PROCESS

As per Section 6 of the code, whenever a corporate debtor defaults in payment, the process of corporate insolvency resolution may be initiated by a financial creditor, an operational creditor or the corporate debtor itself. An application for initiating corporate insolvency resolution process against a corporate debtor is filed before National Company Law Tribunal (NCLT). Within fourteen days of receipt of the application, NCLT ascertains existence of the default and if default exists, the NCLT admits the application. Within 180 days from the date of admission of the application, the NCLT has to bring a resolution plan. This time period can be further extended to maximum of 90 days and not beyond that to ensure time bound resolution. The NCLT through resolution professional make effort to protect and preserve the value of the property of the corporate debtor. Further in 2019, the code wasamended, and a proviso was inserted in Section 12 which requires that the resolution process must be mandatorily concluded within 330 days. This amendment ensures to bring discipline amongst the stakeholders to avoid inordinate delays in the insolvency resolution process. However, if no resolution plan is achieved within 330 days from the date of admission of the Application, then liquidation of defaulting firm will start.

Implementation of the Code so far

The code has set up a robust ecosystem in a short span of 3 years, where debtors and creditors are initiating resolution process under the provision of this code. In June 2017, RBI issued a circular for quick recovery and settlement of stressed assets for twelve of its largest defaulters. In the circular, it was mandatory to bring resolution plan for these defaulters within 180 days. Bhushan Steel was the first company which emerged successful under the 2016 code. In this case, Tata Steel bought Bhushan Steel and repaid INR 35200 crore out of INR 56,079 crore to financial creditors though with 35% haircut. But this successful resolution was historic in nature from the perspective of the amount recovered.

There is no denying that the gross NPAs of Scheduled Commercial Banks (SCBs)have been increasing continuously for the reason stated above. As per the RBI data the gross NPAs stood at INR3,23,464 crores as on March 31, 2015 and increased to over INR10.36 lakh crores figure by the end of 2017-18 fiscal on March 31. However, there is some respite in the last financial year as Gross NPAs of SCBs, which stood at INR10,36,187 crores on March 31, 2018, declined by INR97, 996 crores to INR9,38,191 crores as on June 30, 2019. This reduction in the gross NPAs is certainly attributed to efficient and time bound resolution process under the Code.

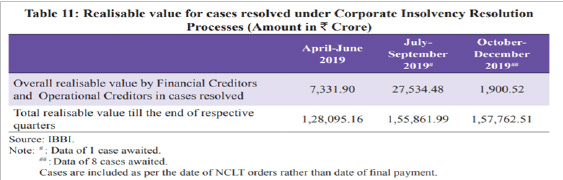

Quarterly trends of cases initiated for resolution under the code has been increasing from 330 cases in April-June, 2019 to 562 cases in October to December 2019. As on end December 2019, INR 1.58 lakh crore were realizedin cases resolved. The realization under the code has been certainly higher i.e. an average of 43% to lenders than the previous regime which was 23%. And also average time taken under the code is 330 days in contrast to this the average time taken for resolution under previous regime which was 4.3 years. Therefore, the enactment of the code has been instrumental in recovery of NPAs.

Some Challenges

As said above, recovery under the code is far more than recovery under earlier regime, yet there are some challenges which are yet to be resolved. The biggest concern is that as per the IBBI data over half of the cases closed under corporate insolvency resolution plan ended up in liquidation and only 14.93 per cent ended with a resolution plan approved. This data somewhere shows that this new system is running away from its intended purpose. The other challenge is that the largest NPAs are not yet resolved. Entire NPA in the resolution plan is not recovered, there is always some haircut. So far the success of resolution under this new system has been achieved in only selected sector such as steel.

Way Forward

There is a need of differential treatment in handling the amount of NPAs. For example higher NPAs should be resolved differently than the lower one. It is high time to implement therecommendation of Sunil Mehta Committee, which classify NPAs in three category and these categories should be handled separately either by asset management companies if the NPA amount is higher or by bank led resolution if the NPAs amount is lower. Also the time limit to bring resolution plan should be proportionate to the amount of NPAs.

Conclusion:

It is hard to tangibly decide the impact of efficient resolution process under the code. The direct measures fail to account for the enabling and preventive role played by the code so far. However, within a short span of 3 years, the codehas proven to be a sustainable solution to NPAs problem and the Government and RBI in consultation with stake holder must resolve any concern arising in the current scheme either by way of regulation or circular etc.

Article by Manish Aryan and Mini Raman was 1st published in Legal Era